ID ITD 3366 2013-2024 free printable template

Show details

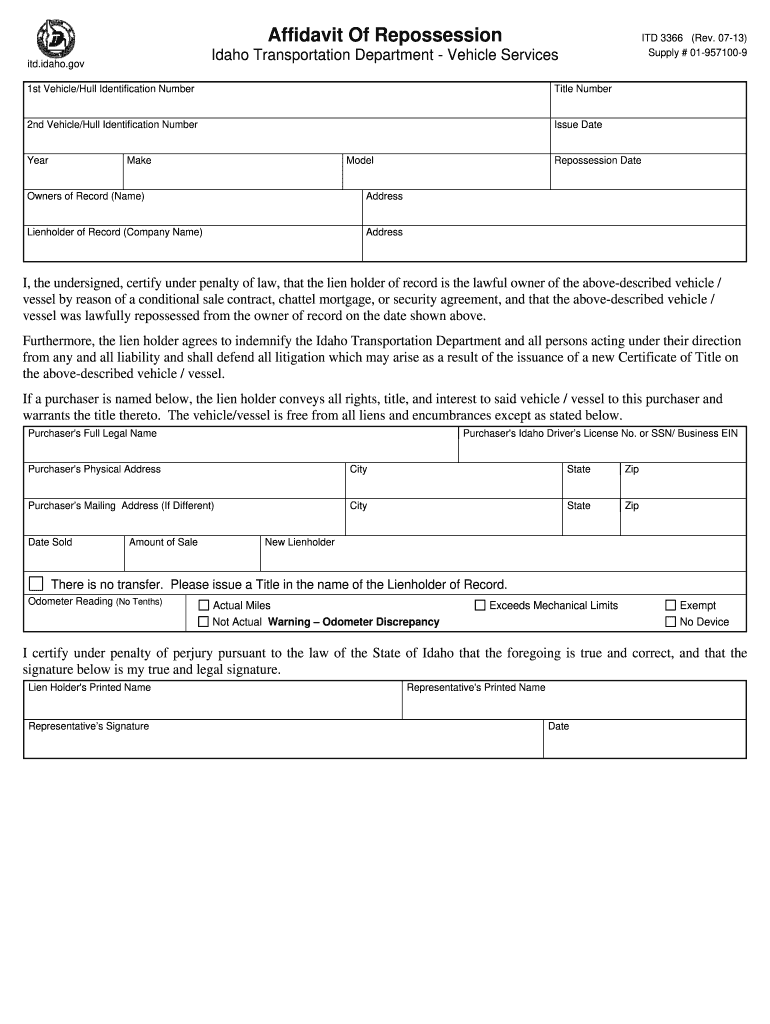

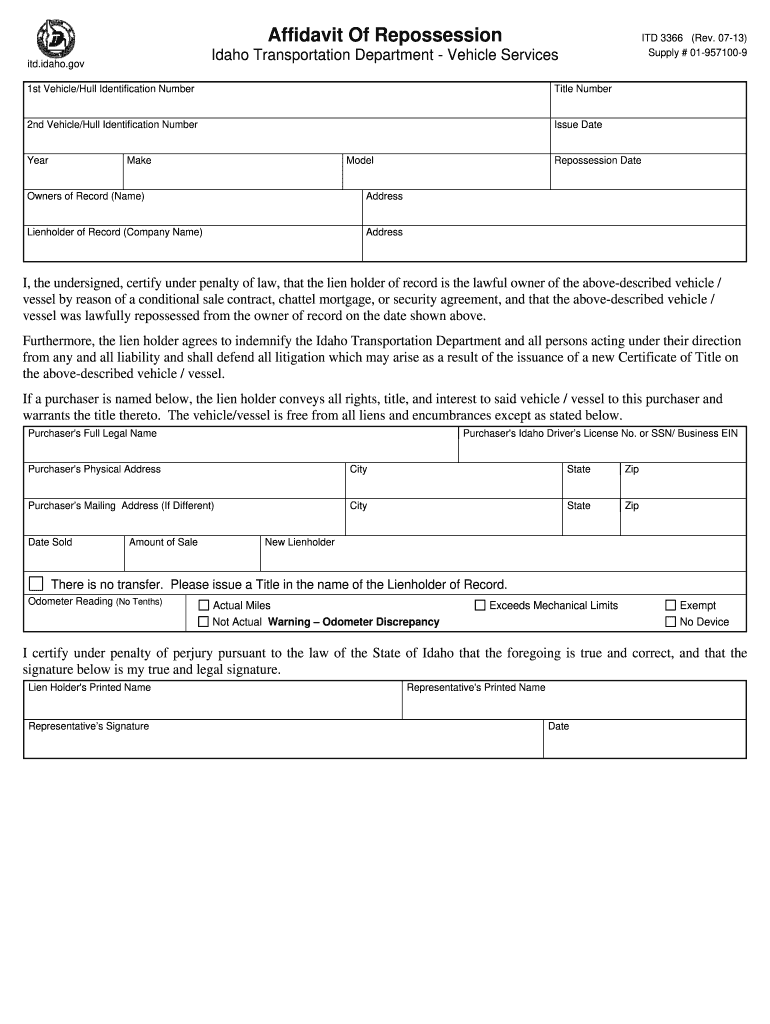

IT 3366 (Rev. 11-09) Supply # 01-957100-9 1st Vehicle/Hull Identification Number Affidavit Of Repossession Idaho Transportation Department Vehicle Services TitlNumberedtd.Idaho.gov 2nd Vehicle/Hull

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your lien idaho form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lien idaho form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lien idaho online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit repossession idaho form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out lien idaho form

How to fill out lien Idaho:

01

Gather the necessary information: Before filling out the lien Idaho form, make sure you have all the required details such as the debtor's name, address, and the property description.

02

Download the lien form: Visit the Idaho state website or contact the appropriate government office to obtain the lien form. Ensure you have the correct and up-to-date version.

03

Review the instructions: Read through the instructions provided with the lien form carefully. Understand the requirements and the specific information you need to provide.

04

Provide debtor information: Fill out the form with the debtor's name, address, and any additional identifying information required. Ensure accuracy and double-check the spelling.

05

Provide property information: Include the details of the property related to the lien, such as the address or legal description. Make sure the information is accurate.

06

Describe the debt: Explain the nature of the debt or the reason for the lien. Be clear and concise in your description.

07

Indicate the amount owed: Specify the exact amount owed by the debtor. Provide any relevant supporting documents or evidence if required.

08

Sign and date the form: Once you have completed filling out the form, sign and date it as required. Make sure all necessary fields are properly filled.

Who needs lien Idaho?

01

Contractors: Contractors who have performed work on a property and have not been paid may need to file a lien Idaho to claim the money owed.

02

Suppliers: Suppliers who have provided materials for a construction project and have not received payment may also need to file a lien to protect their interests.

03

Subcontractors: Subcontractors who have not been paid by the contractor they worked under may need to file a lien Idaho to secure their right to payment.

04

Property owners: Property owners who need to dispute a lien filed against their property may need to understand the details and requirements of the lien Idaho process.

05

Legal professionals: Attorneys or legal professionals with clients involved in lien disputes or transactions may need to assist in filling out lien Idaho forms and ensuring compliance with state laws.

Note: It is advisable to consult with a legal professional or seek expert advice to ensure proper understanding and execution of the lien Idaho process.

Fill id repossession : Try Risk Free

People Also Ask about lien idaho

What is a notice to lien form in Idaho?

How do I release a lien on a property in Idaho?

How long does a property lien last in Idaho?

How do I get rid of a lien in Idaho?

Where do I file a lien in Idaho?

What is a notice of intent to lien in Idaho?

How long is a lien good for in Idaho?

How long do you have to file a lien in Idaho?

How do I put a lien on someone's property in Idaho?

How do I file a lien in Idaho?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lien idaho?

Lien Idaho refers to a legal mechanism that allows a creditor to secure a debt by placing a lien on a property in the state of Idaho. A lien is a claim or encumbrance on a property, granting the creditor the right to take or sell the property if the debtor fails to fulfill their financial obligations. In Idaho, various types of liens can be placed on properties, including tax liens, mechanic's liens, and mortgages. These liens ensure that the creditor has a priority claim on the property and increases their chances of recovering the debt owed to them.

Who is required to file lien idaho?

In Idaho, certain contractors, laborers, and suppliers may be required to file a lien to protect their right to payment for work or materials provided on a construction project. This includes individuals or entities who have provided labor, work, or materials to improve real property, such as contractors, subcontractors, suppliers, architects, engineers, and laborers. It is recommended to consult with an attorney or a legal professional to determine specific requirements and obligations for filing a lien in Idaho.

How to fill out lien idaho?

To fill out a lien in Idaho, all steps must be followed accurately. Here is a step-by-step guide:

1. Provide the necessary information for the lien. This includes the name and address of the lienholder (person or entity filing the lien), as well as the name and address of the property owner.

2. Specify the type of lien being filed. Common types of liens include mechanic's liens for construction work or material provided, judgment liens for court-ordered debts, tax liens for unpaid taxes, etc.

3. Include a detailed and accurate description of the property that the lien is being placed on. This typically involves providing the legal description of the property as indicated in the deed or other official documents.

4. State the amount of the lien. This should reflect the total amount owed, including any interest or additional fees if applicable.

5. Attach any supporting documents to your lien. This might include invoices, contracts, receipts, certificates of completion, or any other relevant paperwork that supports your claim.

6. Submit the completed lien form to the appropriate county recorder's office. In Idaho, liens are recorded at the county level. Visit the county recorder's office or their website to obtain the necessary forms and find information regarding any filing fees or additional requirements.

7. Pay any required fees. Make sure to inquire about the filing fee for the lien and any other associated costs. Some counties may require additional fees for certified copies or expedited processing.

8. After submitting the lien, keep a copy of the filed document for your records. This will serve as proof of your filing if any disputes arise in the future.

Note: It is highly recommended to consult with a legal professional or an attorney familiar with liens to ensure compliance with Idaho state laws and regulations.

What is the purpose of lien idaho?

Lien in Idaho, or any other state, is a legal claim imposed on a property to secure the payment of a debt or obligation. The purpose of a lien in Idaho is to protect the rights of creditors by providing them with a legal avenue to recover the money owed to them. It allows creditors to have a claim on the property until the debt or obligation is satisfied, ensuring that they have a higher chance of getting paid. Liens can be placed on properties for various reasons, such as unpaid taxes, unpaid contractor services, unpaid medical bills, or unpaid loans.

What information must be reported on lien idaho?

When reporting a lien in Idaho, the following information is typically required:

1. Debtor Information: Full legal name and address of the person or entity against whom the lien is being filed.

2. Creditor Information: Full legal name and address of the person or entity filing the lien (the creditor).

3. Amount of the Lien: The total amount of the debt or obligation that the lien is securing.

4. Date of the Lien: The date when the lien was created or recorded.

5. Description of the Property: A detailed and accurate description of the property that the lien is being placed upon. This may include the property's address, legal description, or any other identifying information.

6. Recording Information: The county where the lien is being filed, the recording office, and any applicable reference numbers for the lien.

7. Signature: The lien must be signed by the creditor or their authorized representative.

The specific requirements for reporting a lien in Idaho may vary slightly depending on the county in which the property is located. It is crucial to consult the specific county's recording office or a legal professional for accurate and up-to-date information. Additionally, it is generally recommended to follow the guidelines and regulations outlined by the Idaho Statutes and/or relevant local ordinances.

How can I send lien idaho for eSignature?

Once your repossession idaho form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in idaho 3366 blank?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your lien record to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit itd 3366 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing idaho affidavit repossession form.

Fill out your lien idaho form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idaho 3366 Blank is not the form you're looking for?Search for another form here.

Keywords relevant to idaho affidavit of repossession form

Related to id itd 3366

If you believe that this page should be taken down, please follow our DMCA take down process

here

.